In the ever-evolving landscape of finance, a new player has emerged, capturing the attention of investors, technologists, and curious onlookers alike. Cryptocurrency—a digital frontier marked by innovation and intrigue—continues to reshape the ways we think about money, security, and even community. Each day brings a wave of developments, from groundbreaking partnerships to regulatory shifts and technological advancements, all contributing to the vibrant tapestry of crypto news. In this article, we navigate the latest headlines, unearthing insights and trends that illuminate the path forward in this dynamic arena. Whether you’re a seasoned trader or a newcomer to the world of digital assets, our exploration of recent events will provide you with a comprehensive overview of where the cryptocurrency landscape stands today. Join us as we delve into the pulse of the crypto market, where every ticker movement tells a story, and each update could hold the key to tomorrow’s opportunities.

Emerging Trends Shaping the Future of Cryptocurrency

The cryptocurrency landscape is undergoing rapid transformation, driven by innovations and regulatory changes. One prominent trend is the rise of decentralized finance (DeFi), which is reshaping how users interact with financial services. With platforms offering lending, borrowing, and yield farming without traditional intermediaries, the allure of higher returns has attracted a diverse audience. Furthermore, the integration of non-fungible tokens (NFTs) has also found its place in DeFi, allowing digital assets to be collateralized for loans, thus expanding the utility of blockchain technology.

Another significant trend is the increasing focus on regulatory compliance as governments around the world strive to establish frameworks for cryptocurrency transactions. This regulatory scrutiny could lead to a more stable market and greater confidence among mainstream investors. Notably, the emergence of central bank digital currencies (CBDCs) has created a hybrid space where traditional finance intersects with cryptocurrency. A few notable implementations include:

| Country | CDBC Status | Launch Year |

|---|---|---|

| China | Pilot Phase | 2020 |

| Sweden | In Development | 2023 |

| USA | Research Phase | N/A |

Regulatory Developments and Their Impact on Market Dynamics

The regulatory landscape surrounding cryptocurrencies is evolving at an unprecedented pace, prompting significant changes in market behavior and participant strategies. Recent legislative efforts in major economies have sparked debates about the implications for asset ownership, trading practices, and the operational frameworks of decentralized finance. Key developments include:

- Enhanced Compliance Requirements: Governments are introducing stricter KYC (Know Your Customer) and AML (Anti-Money Laundering) protocols, pushing exchanges to adapt or face penalties.

- Taxation Clarity: As regulations clarify tax obligations on crypto transactions, market participants are adjusting their investment strategies to mitigate unexpected liabilities.

- Influence of Central Bank Digital Currencies (CBDCs): The development of CBDCs by countries like China and the EU raises questions about the future role of cryptocurrencies in the financial system.

| Regulatory Aspect | Impact on Market |

|---|---|

| Compliance Standards | Increased operational costs for exchanges |

| Tax Regulations | Shift in trading behavior to avoid high capital gains taxes |

| CBDC Initiatives | Potential dilution of crypto’s appeal as a decentralized alternative |

While these regulatory changes aim to understand and control the burgeoning crypto economy, they also present challenges and opportunities for investors. As compliance becomes more intricate, market participants must enhance their risk management strategies and stay informed about legal obligations. Furthermore, the interplay between cryptocurrencies and evolving regulatory frameworks is likely to shape long-term investment potentials and community trust in digital assets.

Innovative Technologies Transforming Blockchain Applications

As the landscape of digital currencies evolves, innovative technologies are pushing the boundaries of blockchain applications. One standout is smart contracts, which automate and enforce agreements without the need for intermediaries. This technology enhances trust and transparency, reducing time and costs in transactions. Additionally, the rise of layer-2 scaling solutions seeks to overcome the limitations of traditional blockchains, increasing transaction speeds and lowering fees, thereby making blockchain networks more practical for everyday use.

Moreover, the integration of artificial intelligence (AI) with blockchain is fostering a new wave of applications focused on data security and analytics. AI can analyze vast amounts of data generated on blockchain networks, offering insights that drive decision-making and bolster security against breaches. Furthermore, interoperability protocols are emerging to connect disparate blockchain networks, allowing for a seamless flow of data and assets across platforms. This creates a more integrated ecosystem, enabling users and businesses to leverage multiple blockchains for optimized performance.

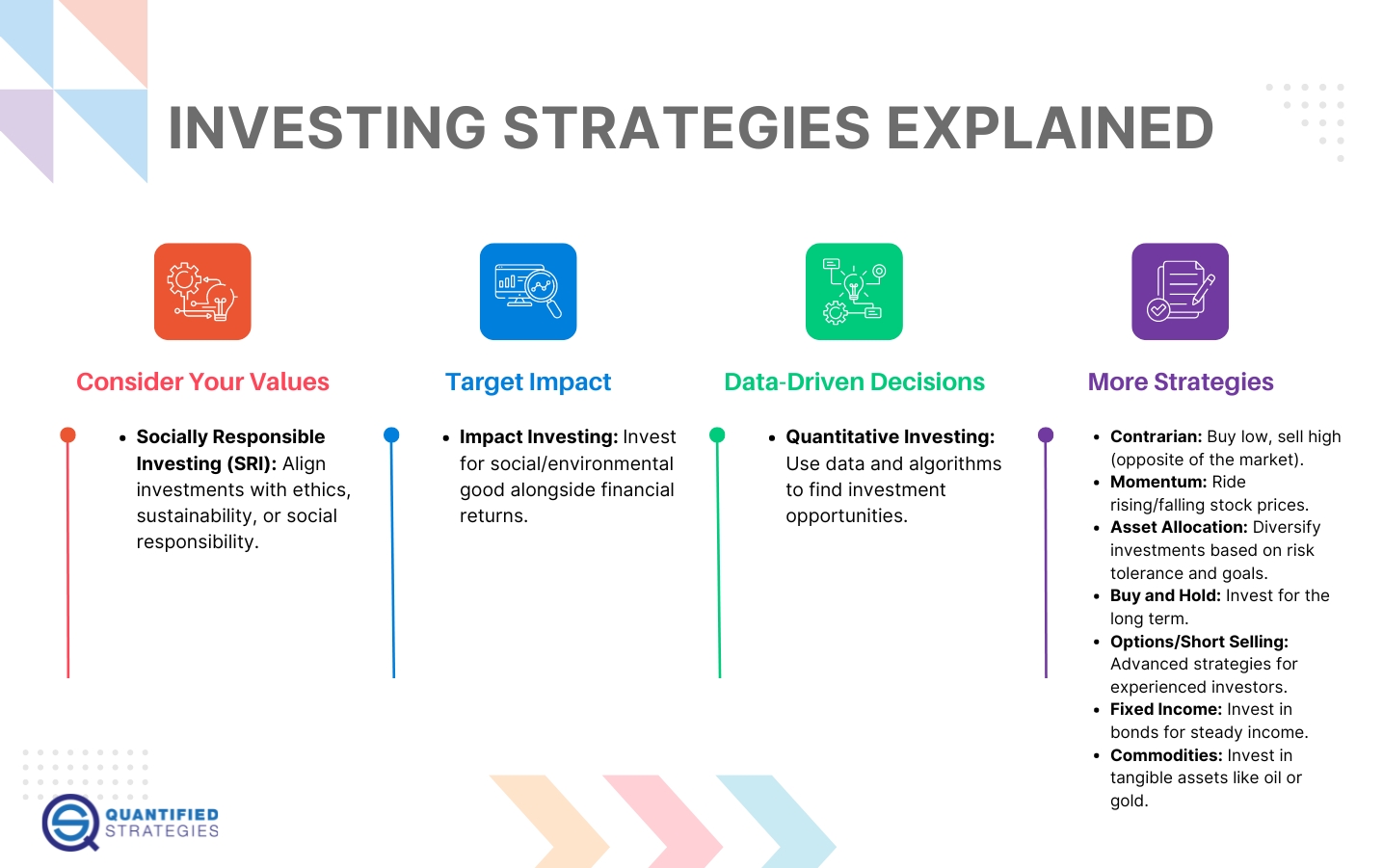

Investment Strategies for Navigating the Crypto Landscape

In the ever-evolving realm of digital currencies, adopting a well-defined strategy is crucial for success. Investors should consider focusing on diversification across various cryptocurrencies to mitigate risks. This can involve allocating funds among well-established coins like Bitcoin and Ethereum, along with promising altcoins that exhibit potential for growth. Additionally, keeping a close watch on market trends and staying informed about technological advancements will help in making educated decisions. A few key approaches to consider include:

- Dollar-Cost Averaging: Invest fixed amounts regularly to reduce the influence of volatility.

- HODLing: Hold onto investments for the long term, avoiding impulse selling during market dips.

- Staking and Yield Farming: Generate passive income by participating in networks and providing liquidity.

Furthermore, it’s essential to utilize analytical tools and resources to track portfolio performance and market sentiment. In addition, being aware of regulatory developments and security measures can safeguard investments. Analyzing return on investment (ROI) can be simplified using the following comparative table:

| Cryptocurrency | Current Price ($) | 1-Year ROI (%) |

|---|---|---|

| Bitcoin (BTC) | 45,000 | 95% |

| Ethereum (ETH) | 3,200 | 120% |

| Cardano (ADA) | 0.90 | 65% |

To Wrap It Up

As we navigate the ever-evolving landscape of cryptocurrency, staying informed is more crucial than ever. Whether you’re a seasoned investor or a curious newcomer, the world of crypto is filled with opportunities, risks, and innovations. In this dynamic environment, knowledge is your best ally, guiding you through market fluctuations and technological advancements alike.

As we close this chapter on the latest crypto news, remember that the journey doesn’t end here. The digital currency realm is multifaceted and continually changing, offering fresh developments that could change the game overnight. Keep your curiosity alive, engage with diverse sources, and don’t shy away from exploring new horizons. With each headline, another piece of the complex puzzle is unveiled. Until next time, stay vigilant, stay informed, and who knows—tomorrow might just bring the news that reshapes the future of finance.